Co-General Partnership Equity Investments

Our Co-GP investment program sources opportunities from our real estate sponsor network through Schelin Uldricks & Co., our capital markets and investment banking services platform.

Co-GP investments focus on assisting emerging real estate sponsors by giving them access to complimentary capital, which enables them to acquire property. Additionally, our GP co-investments allow our investor network to invest on the same or similar terms as our sponsor clients, which offers the potential to increase overall returns.

Some investors are not as familiar with Co-GP investing, and we often have to explain the opportunity to our new clients in great detail before they opt to invest with us in these selected opportunities.

General Partner investing, or GP investing, is potentially a great way to enhance a given return on an investment opportunity. Usually, when a general partner or sponsor puts together a real estate investment opportunity, they syndicate or pool other investors’ capital to purchase the underlying property. It’s typical for a sponsor to invest 10% of the total equity needed as their co-investment alongside limited partners, which provide the remaining 90% of the equity. In exchange for the sponsor’s work in creating value in the property, they typically receive a carried interest or promotion when distributing profits. A promotion is earned if certain valuation metrics are reached when the asset is sold or recapitalized.

In a typical distribution waterfall, both the limited partners and the general partner receive their initial capital contribution back plus a preferred rate of return. Then, if there are additional profits to be split, the limited partners and general partner split the proceeds at some pre-determined level, which gives the general partner a disproportionately higher return (the carried interest) than the limited partners and an incentive to increase the value of the asset. Oftentimes, the general partner receives 20% - 50% of the profits after the limited partners receive their initial investment plus preferred return.

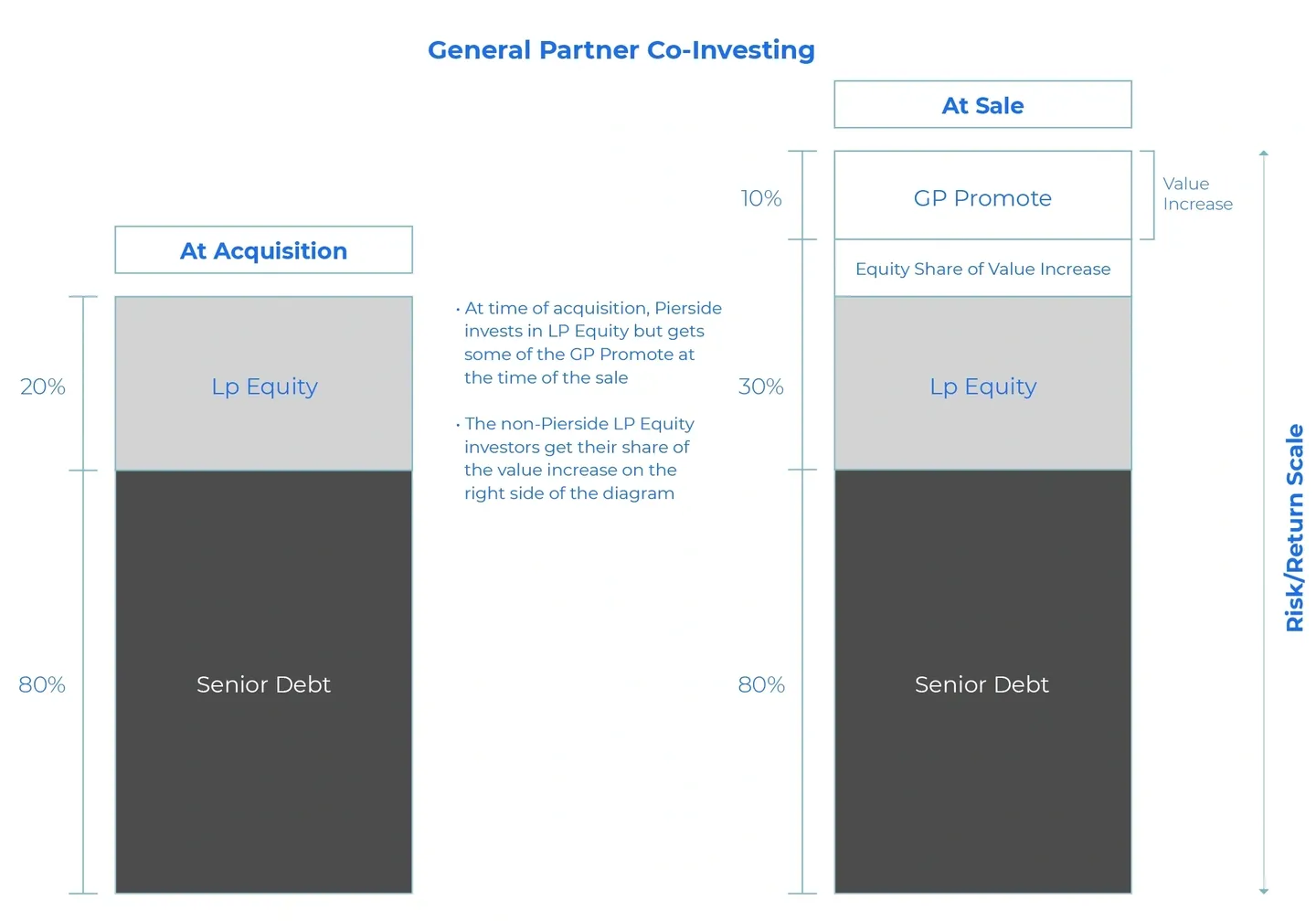

Our firm co-invests alongside the general partner on the general partner’s terms. What this means is that our initial capital investment is treated the same as the other limited partners in the transaction, but we also get a share of the general partners' promoted interest in the deal. Think of the promoted interest as a little extra revenue that helps increase or enhance the overall return.

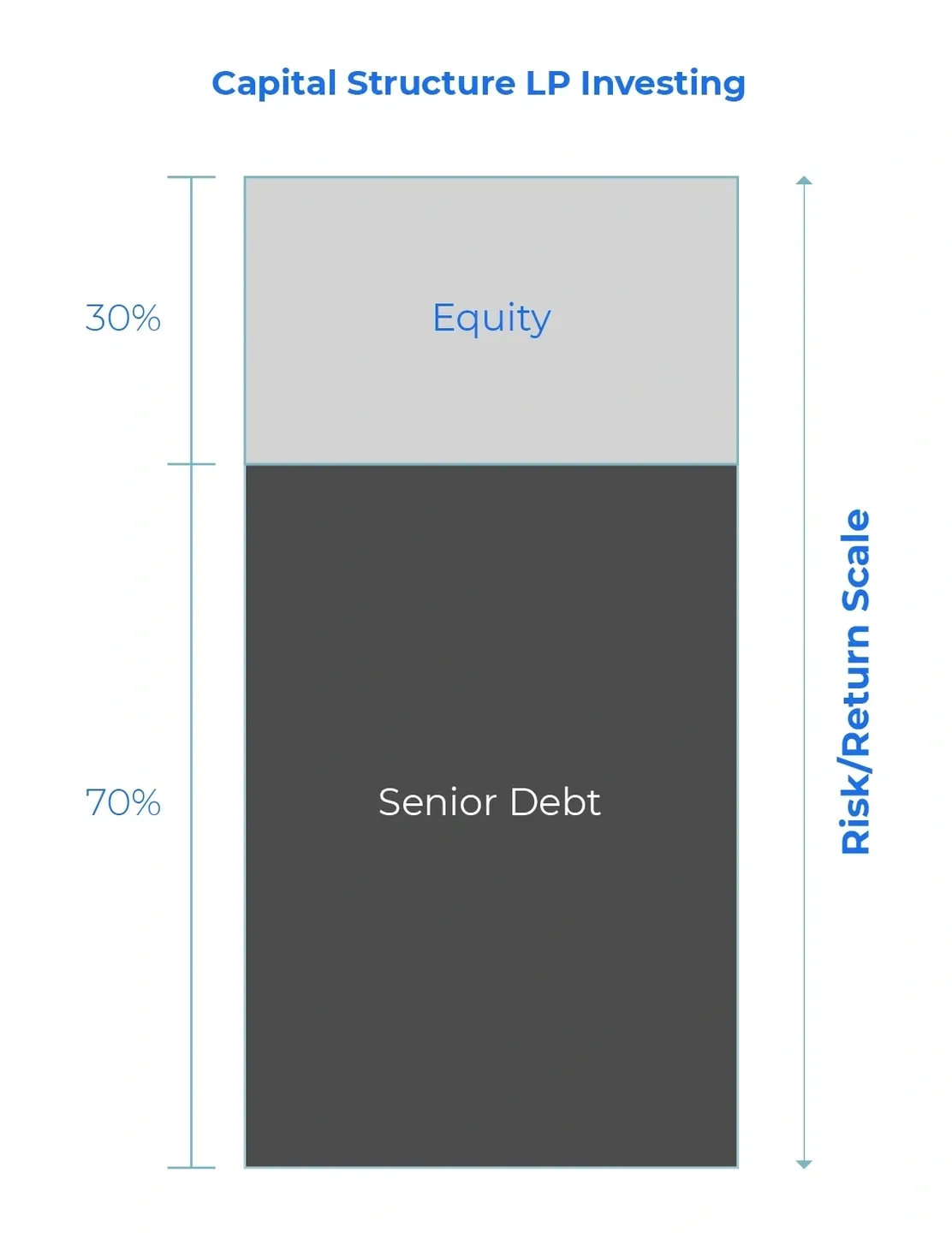

The advantage to our investment is obvious, but it is also helpful to the general partner because it reduces the size of their co-investment. In the earlier example, we highlighted that a general partner usually invests 10% of the total equity needed in a given transaction. To keep things simple, let’s say that a general partner is purchasing a $10,000,000 property and they are obtaining a 70% LTV loan, which equates to $7,000,000. In this scenario, the total equity need is $3,000,000. Under the usual scenario, a general partner puts in 10% of the $3,000,000 as their co-investment in the property, or $300,000, which could be a large investment for a general partner. What we offer the general partner is a way to reduce their investment size and help them maintain their liquidity. In this hypothetical example, let’s assume that we invest 50% of the GP position to arrive at the following investor contribution amounts:

General Partner: 50% of $300,000: $150,000

Pierside Capital: 50% of $300,000: $150,000

Limited Partners: $2,700,000

Total: $3,000,000

Now, assume that on this project, the GP and LP capital contributions are treated equally on their contributions above, but the general partner receives 30% of the distributions upon the LPs receiving their capital back plus an 8% preferred return on their capital contribution. To show the power of co-investing alongside the GP, we will mathematically show our returns by using this strategy. See the following assumptions below:

Sale Price: $13,000,000

Hold Period: 2 years

Debt Financing: $7,000,000 payoff at sale

Example:

Sale: $13,000,000

Repayment of Debt: $7,000,000

Available for Distribution: $6,000,000

Less: GP & LP Preferred Return ($3,000,000 x 8% x two years): $480,000

Less: GP & LP Return of Capital: $3,000,000

Remaining for Distribution after the return of capital: $1,764,000

Less: 70% to GP & LPs: $1,234,800

Less: 30% to Promote GP: $529,200

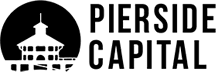

The table above shows how the distributions are split amongst the limited partners and the general partner group (which includes Pierside Capital). The table below shows how the general partnership is split up between Pierside Capital and the operator:

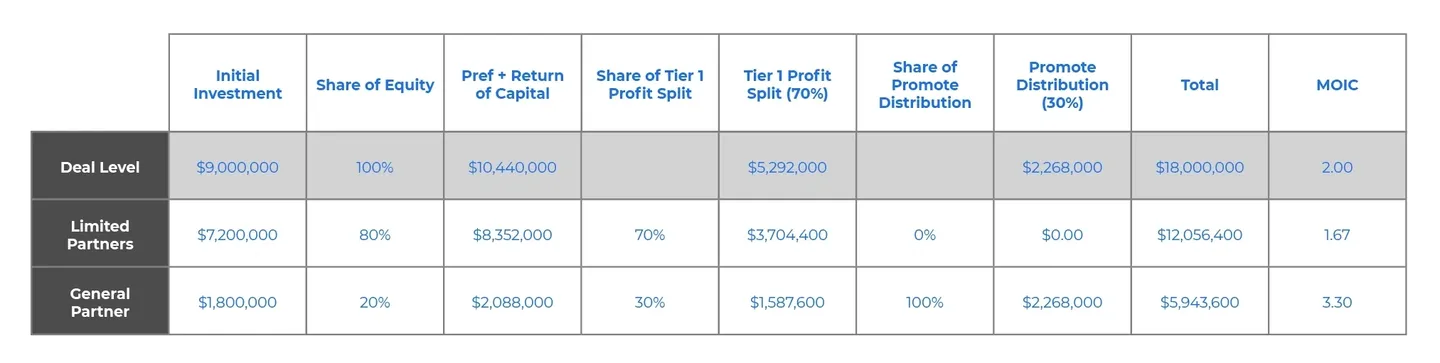

In this example, the overall return for Pierside is much higher than that of the typical LP investor, at the same level of risk as that of the limited partner. We are still seeing a lower return than the sponsor/operator. Although we invested 50% of the GP co-investment, we typically do not get equal treatment on the carried interest. In this example, we assume that Pierside Capital gets 25% of the carried interest while the operator/sponsor retains 75% of the carried interest. The table below shows the overall IRRs and index of the varying returns amongst the standard LP investors, Pierside Capital, and the operator/sponsor:

In summary, co-GP investing is a version of LP investing that can allow for higher returns, assuming that the carried interest is in the money. The capital contribution we make is on identical terms to the other LP investors, with the caveat that the general partner is sharing some of their carried interest with Pierside Capital.

Many of our general partner clients are in need of this type of capital. If we can reduce their investment amount by 40% - 50%, they can turn around and use those funds to purchase more assets or maintain higher levels of liquidity, often required by senior lenders.

Pierside Pref Equity Investments

Our Participating Preferred Equity investment program sources opportunities from our real estate sponsor network through Schelin Uldricks & Co., our capital markets and investment banking services platform.

Participating in Preferred Equity investments focuses on assisting real estate sponsors by providing “gap” capital for their projects. In a rising interest rate environment, sponsors have to contend with tightening financial conditions on the senior debt portion of their project financing. As interest rates rise, less revenue is available to service the debt, which has the effect of lowering the amount of senior financing a sponsor can source for their acquisition or refinance. As loan proceeds come down, sponsors need to fill that gap with either preferred equity or common equity. Common equity investors are very selective when there is market volatility, so rising interest rates have the effect of crowding capital out of common equity and into safer investments, since lower assets like government debt offer higher coupons. Our program focuses on providing these sponsors with preferred equity to recapitalize their projects. Many large institutions are now setting aside funds to pursue this strategy in anticipation of a great wave of commercial real estate debt maturing over the next several years. Our niche is to provide $500,000 - $3,000,000 preferred equity investments in the lower to middle market of commercial real estate, which is an area we believe is under-served. Our focus is making investments in multifamily assets, but we would consider other asset-type investments on a case-by-case basis.

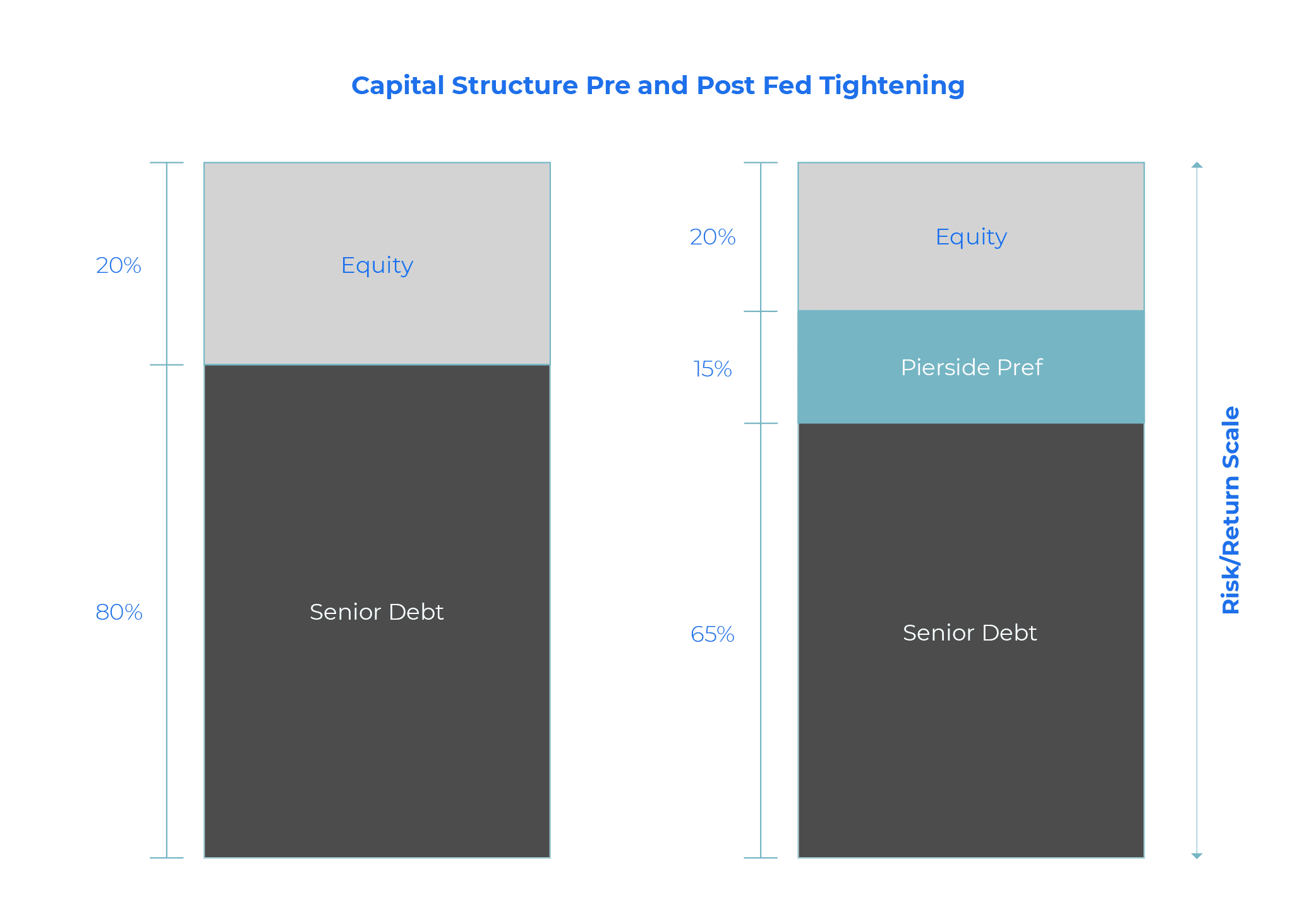

The graphic below shows the impact of rising interest rates on a commercial real estate project. The bar graph on the left shows a typical capital structure pre-2022. Lenders were more willing to lend up to higher LTVs because the projects had better cash flow when interest rates were lower. Fast-forward to today, and lenders have tightened their lending standards, thus reducing the amount of capital a sponsor can source from their senior debt counterparts. Pierside aims to invest in the gap portion of the capital structure.

Our investments usually stop at 85% of the value of the project. The benefit to investing in preferred equity is that our investment is not in a first-loss position should the value of the project decrease. In other words, the value of the project would need to decline by 15% before our principal is impacted. The investments are structured with a higher rate of return than senior debt but a lower overall return than common equity. Our preferred equity investments have a higher interest rate charged to the property, anywhere from 13% - 16%. On occasion, we will also be able to negotiate the inclusion of a portion of the residual equity in the project from the sponsor. In the industry, this is known as an “equity kicker” or “equity participation” and can be an interesting way to increase our overall returns. With participation, our preferred equity investment’s overall return can look more like an LP equity-level return while still taking the more senior preferred equity position.

Limited Partnership Equity Investments

Our Limited Partnership Equity investment program offers investors the opportunity to invest alongside Pierside Capital in transactions where Pierside functions as the sponsor of the offering. Our investment strategy is to target value-add and special situation residential real estate in the lower to middle market. The deals we sponsor are focused on the southwestern US in California and Arizona. We target markets that have dense populations and diverse employers across all industry types.

The scenarios provided herein are intended to illustrate mathematial principals only. There is no guarantee that any investment strategy will achieve its objectives.